year end accounts date

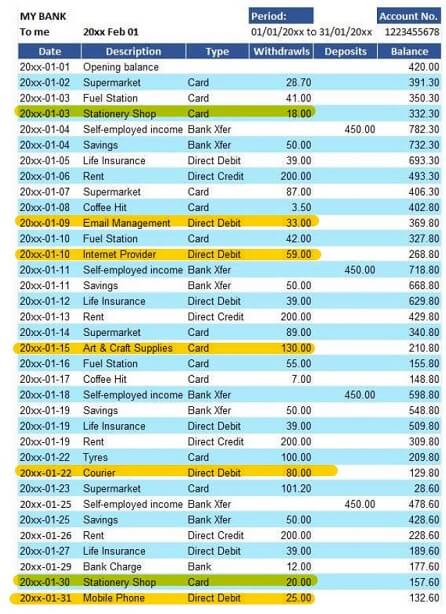

Prepare a closing schedule. The first accounting year end date for a new company is the last day of the month in which the first anniversary falls on.

Fiscal Year Explained How To Choose One For Your Business Bench Accounting

Accounting Year End Date will sometimes glitch and take you a long time to try different solutions.

. For those ages 50 or older you can contribute an additional 6500 for a total of 27000. It also includes the same date when. You can shorten your companys financial year as many times as you like - the minimum period you can shorten it by is 1 day.

The year end date will be the end of the month in which the company was set up. Means the audited balance sheets as at the Year-end Accounts Date and audited profit and loss accounts and the audited cash flow statements for the year ended. Change your financial year end date.

Year-end refers to the end of your companys accounting period. These accruals are recorded by certain offices such as Facilities Dining and OIT at year end during 1st and 2nd close. 8 hours ago1 Official date moving 1 day can add 3 months to filing deadline 2 Accounts date can be up to 7 days before or after the official date 3 No a day does not get counted twiceThe.

The goal of the year-end closing process for accounting is to issue financial statements at the close of the fiscal year. The date by which the companys accounting period is going to end is known as the Year end of a Company. It is also known as an accounting reference date for limited companies.

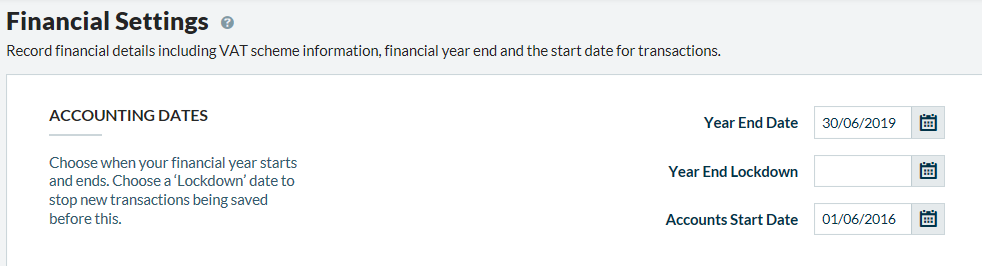

What is Year-End. On the right-hand side enter the dates. This allows you to continue working as usual whilst you finalize your accounts for the year end.

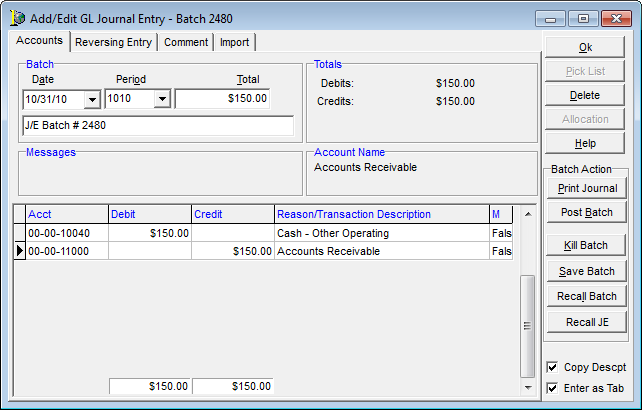

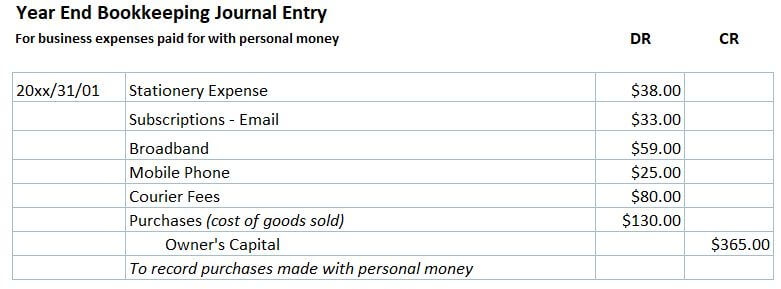

The closing entryentries is one that consists of clearing off all income and expense accounts this is commonly known as your Profit and Loss account which. These include reporting and data processing deadlines and the fiscal close. The rules on changing your financial year end.

Year-end refers to the conclusion of an organizations fiscal year. At the end of your. The record is marked as Reversed and stamped with the date and time.

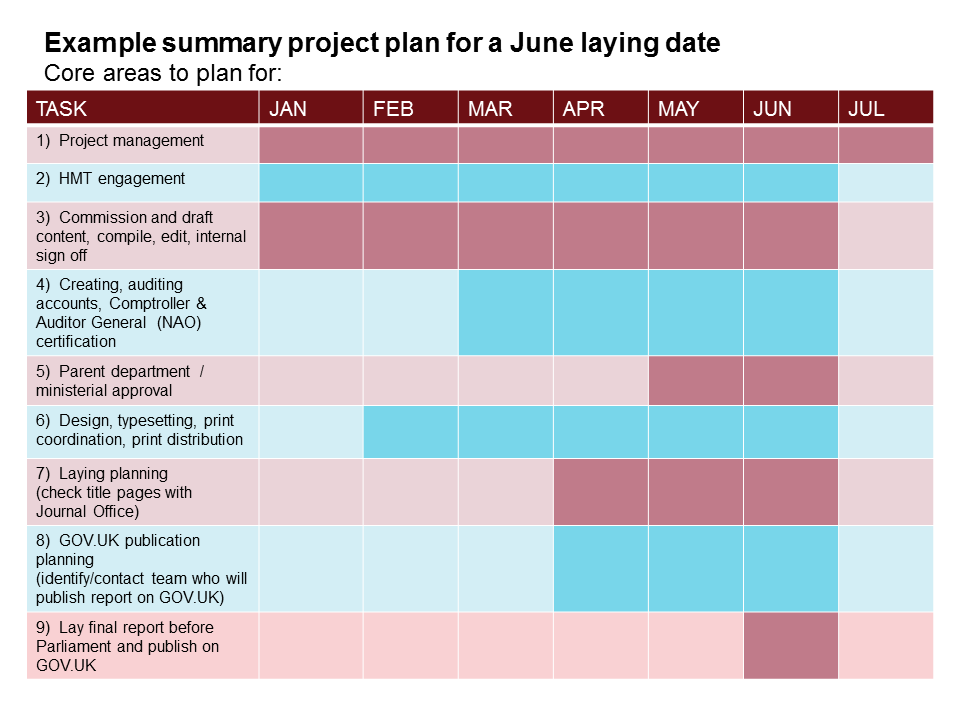

Identify the important dates and the activities that must be completed by each. Vintage must issue financials for the 123121 year end which is the. This is when you close your.

21 months after the date you registered with Companies House. For example if your company was incorporated on 15 January 2021. Examples of Central Office accruals are utility bill accruals that span.

The year end of the limited company will have been set by Companies House when the company was formed. More than 12 months for example after you lengthen your company year. The balance of the main account can be transferred to a new main account during the year-end close.

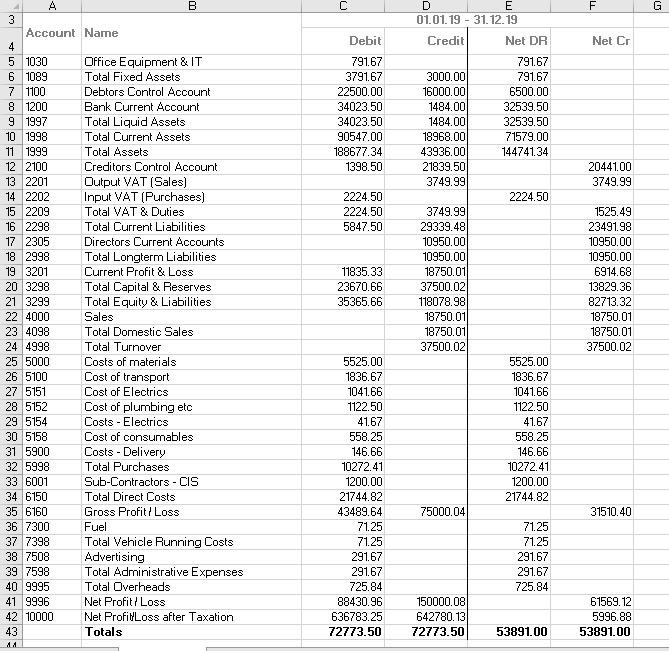

Many firms observe a calendar year end in which case their year-end is December 31. 2 days agoYou can contribute up to 20500 in 2022. Profit and loss accounts All values for these accounts prior to the financial year start date appear against Profit and Loss Account 3100.

The closing entries. For an unincorporated business profits for the year are decided. If your company is incorporated a financial year end date will determine when payment of tax falls due.

LoginAsk is here to help you access Accounting Year End Date quickly and handle. Contributions from your employer dont. Its normally the same 12 months as the company financial year covered by your annual accounts.

Your accounting period can also be different to your financial year when your accounts cover. Go to Accounting Accounting periods.

Accounts Payable Clerk Cover Letter Examples Qwikresume

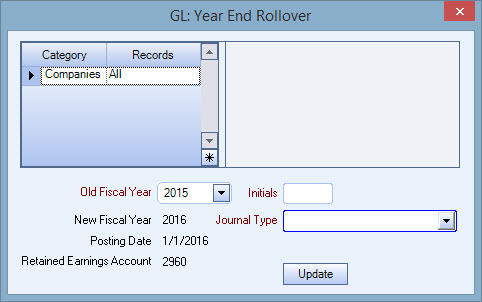

Year End Closing Gl Pdf Debits And Credits Revenue

Must Have Year End Checklist For Small Business Bookkeeping Shockley Tax Services Bookkeeping

Annual Report And Accounts The National Archives

Which Accounts Are Not Closed At The End Of An Accounting Period

10 End Of Year Bookkeeping Tips

Fast Tax Services Ltd Year End Accounts

Expert Answer Warner Company S Year End Unadjusted Trial Balance Shows Accounts Receivable Of Brainly Com

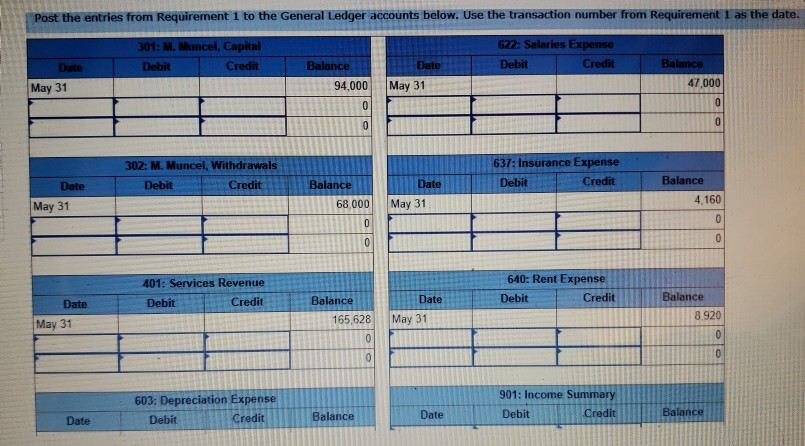

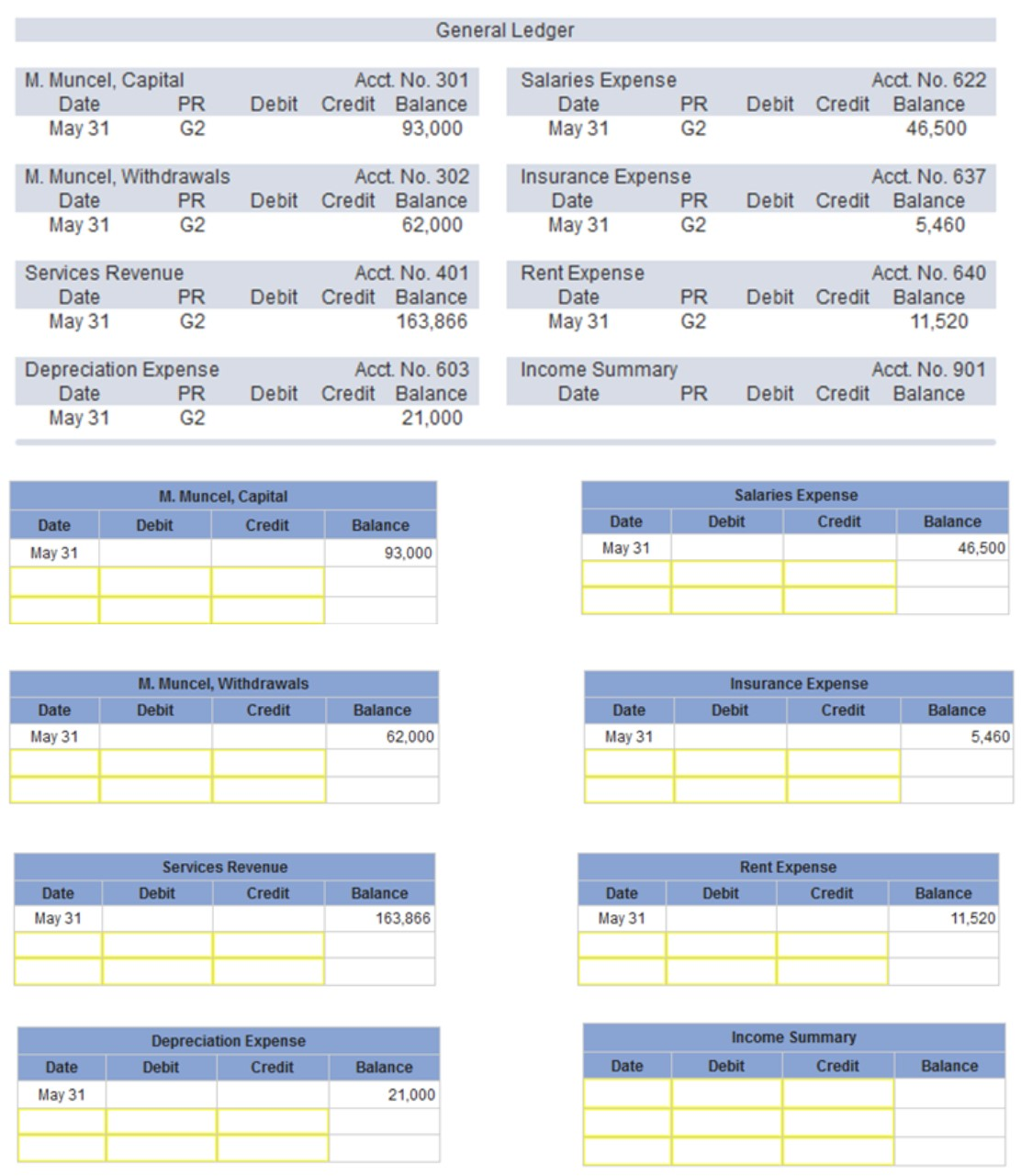

Solved Use The May 31 Fiscal Year End Information From The Chegg Com

Abc Of Accounting The Year End Closing Entries

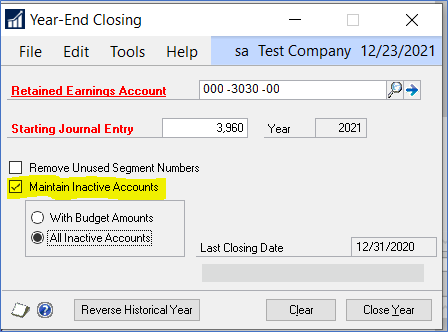

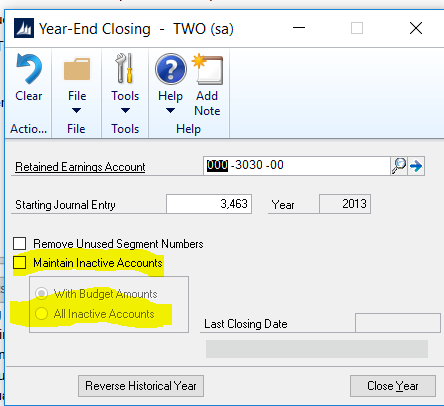

How To Handle G L Year End Close And Inactive Accounts

10 End Of Year Bookkeeping Tips

Gp Tip Beware Of Maintain Inactive Accounts Option In Year End Closing

How To Use The New Up To Period Filter In Sage Intelligence For Accounting

Solved Use The May 31 Fiscal Year End Information From The Chegg Com

Solved At Year End December 31 2020 Corolla Sales Showed Unadjusted Balances Of 396 000 In Accounts Receivable 14 200 Debit In Allowance For Course Hero

:max_bytes(150000):strip_icc()/accountingperiod_definition_final_0929-6a0f18d7c7e744d4a1aee1de9e84d54f.png)